696 credit score|696 credit score rating : Clark Learn what a 696 credit score means, how it compares to other scores, and how to boost it. Find out the factors that affect your score, such as payment history, utilization rate, and credit mix. See more Diga-se de passagem que eram super limpos e equipados com álcool em gel e papel. Tem opção pra quem quer total privacidade e para quem curte ser observado. Agrada quem gosta de ser visto e quem gosta de ver. Ou seja, há espaço para vários tipos de excitação. Circulando pela casa de swing, vi gente vestida de tudo quanto é jeito.

0 · is 696 a good credit

1 · 696 credit score rating

2 · 696 credit score mortgage rate

3 · 696 credit score mortgage

4 · 696 credit score credit cards

5 · 696 credit score cards

6 · 696 credit score car loan

7 · 696 credit karma

WEBIt’s too big 😉😉willow harper, onlyfans willow harper, willowharper upvotes .

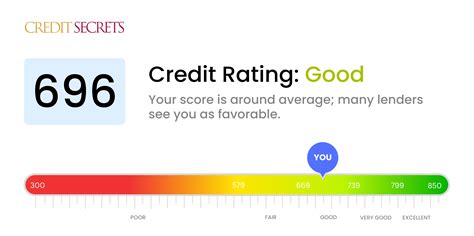

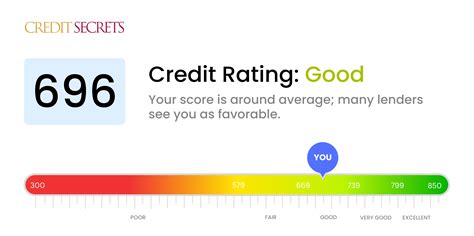

696 credit score*******Learn what a 696 credit score means, how it compares to other scores, and how to boost it. Find out the factors that affect your score, such as payment history, utilization rate, and credit mix. See more

A FICO® Score of 696provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an . See more

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with . See more

Having a Good FICO®Score makes you pretty typical among American consumers. That's certainly not a bad thing, but with some time and effort, you can . See moreHaving a Good FICO®Score makes you pretty typical among American consumers. That's certainly not a bad thing, but with some time and effort, you can . See moreYour FICO®Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually . See more A 696 credit score is a fair credit score, not a good credit score. You generally need a credit score of 700 or higher to be classified as having good credit, so . A 696 credit score is generally a fair score that may limit your access to favorable credit cards and loans. Learn how to improve your credit health with tips and insights from Credit Karma.

The FICO score range, which ranges from 300 to 850, is widely used by lenders and financial institutions as a measure of creditworthiness. As you can see . A 696 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 percent on a used .

NerdWallet’s credit score bands, used for general guidance. Generally speaking, a good credit score is 690 to 719 in the commonly used 300-850 credit score range. Scores 720 and above . Learn what a 696 credit score means for your loan eligibility and interest rates, and how to improve your score with Upstart. Find out how credit card, auto .For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit .With a credit score of 696, you stand in a fairly good position to be approved for a mortgage. This score is above the average and well within the range that most lenders .

A 696 credit score is considered average in the United States. While it may not be excellent, it is still within an acceptable range for many lenders and creditors. With a 696 credit score, individuals may qualify for loans and credit cards, although the interest rates may be slightly higher compared to those with better scores. It’s a little complicated. For starters, you don’t have just one single credit score. It’s much more likely that you have many different credit scores generated by many different credit-scoring models. The most widely recognized credit scores, like those developed by FICO and VantageScore, usually fall in the 300 to 850 range. Though it varies across credit scoring models, a score of 670 or higher is generally considered good. For FICO, a good score ranges from 670 to 739. VantageScore deems a score of 661 to 780 to be good. A credit score that falls in the good to excellent range can be a game-changer.

With a credit score of 696, you stand in a fairly good position to be approved for a mortgage. This score is above the average and well within the range that most lenders consider acceptable for a loan. However, it's crucial to remember that a credit score, while important, is just one aspect that lenders consider when deciding on mortgage .A FICO ® Score of 676 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO ® Score, 714, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO ® Scores "acceptable" borrowers, which means they consider you eligible for a broad variety of credit products .696 credit score You typically need a fair credit score (580 to 669) to get a balance transfer credit card, although you may qualify for a secured card despite a bad credit score. To be safe, you want to have a FICO score of at least 600 for an unsecured balance transfer card. Secured card issuers typically don’t rely on credit scores when evaluating applicants.

NerdWallet’s credit score bands, used for general guidance. Generally speaking, a good credit score is 690 to 719 in the commonly used 300-850 credit score range. Scores 720 and above are .

“Fair” score range identified based on 2023 Credit Karma data. Fair credit does open the door to some possibilities. With fair credit scores, you might qualify for loans with better terms than you would if you were building credit from scratch.You may also be approved for an unsecured credit card with decent interest rates and fees — and maybe .696 credit score rating Usually, higher scores mean lower interest rates on loans. A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.89% or better, or a used .696 credit score 696 credit score rating Usually, higher scores mean lower interest rates on loans. A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.89% or better, or a used . Is a 696 credit score good? Find out where you stand and steps you can take to maintain and improve your credit scores. Enhance your creditworthiness with a 696 credit score. Learn effective ways to boost and maintain your credit standing. . Your credit score determines the interest rates you’ll pay on your loans and the credit limit offered by lenders. They use your credit score to check your ability and likelihood to repay your debts.

In the first quarter of 2024, the overall average auto loan interest rate was 6.73% for new cars and 11.91% for used cars. Experian also provides average car loan APRs by credit score, based on .

The bad news about your FICO ® Score of 496 is that it's well below the average credit score of 714. The good news is that there's plenty of opportunity to increase your score. 99% of consumers have FICO ® Scores higher than 496. A smart way to begin building up a credit score is to obtain your FICO ® Score. Along with the score itself, you . 696 Credit Score: Is it Good or Bad? 696 Good. If your credit score is 696, . According to Experian, the average American consumer has a FICO Score of 714 as of 2021, and anything in the range of 670 to 739 is generally considered to .Credit mix accounts for about 10% of your credit score. 42% Individuals with a 696 FICO ® Score have credit portfolios that include auto loan and 29% have a mortgage loan. Public records such as bankruptcies do not appear in every credit report, so these entries cannot be compared to other score influences in percentage terms. If one or more .

A 696 credit score is a fair credit score, not a good credit score. You generally need a credit score of 700 or higher to be classified as having good credit, so a credit score of 696 falls just short of that threshold. However, even with a 696 credit score, you still have opportunities to obtain decent credit cards or loans. A 696 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit without high fees and interest rates with a score in this range. Percentage of generation with 640–699 credit scores. Generation Percentage; Gen Z: 22.5%: Millennial: 18.4%: Gen X: 18.3%: Baby boomer: The FICO score range, which ranges from 300 to 850, is widely used by lenders and financial institutions as a measure of creditworthiness. As you can see below, a 696 credit score is considered Good. For context, the average credit score in America is 718. Credit Score. A 696 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 percent on a used car. Scores above 720 are more likely to net you the lower percentage rates. If you are having trouble getting approved for a car loan with . If your credit score is 696, you are right in the middle. According to Experian, the average American consumer has a FICO Score of 714 as of 2021, and anything in the range of 670 to 739 is generally considered to be a good credit score.. Most lenders consider an 696 credit score to be an average credit score that shows you generally pay your bills on time. Generally speaking, a good credit score is 690 to 719 in the commonly used 300-850 credit score range. Scores 720 and above are considered excellent, while scores 630 to 689 are considered fair .

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750. In 2023, the average FICO ® Score ☉ in the U.S. reached 715.

web3 de jul. de 2023 · Não queria ta escrevendo isso mas infelizmente o ENALDINHO E ANINHA TERMINARAM eu como fã do enaldinho fico muito triste com isso, mas a vida é assim coisas .

696 credit score|696 credit score rating